Both Personal Capital and Quicken provide a centralized platform to link and value your accounts Integrated Account Information: To accurately understand your financial picture, the best tools integrate seamlessly and securely with your existing accounts, including bank, credit card, loan and investment balances and transactions.Price: Personal finance tools vary widely by cost and functionality, with higher prices indicating a greater level of customization.

Quicken for mac rebalancing software#

The criteria to assess which budget software is right for you includes the following: If looking to pay down debt, systematically save, or manage a small business, your needs will be much different than those looking to invest for retirement. Where you are in your financial management journey will dictate which tool is right for you. Short-term money management decisions must align with longer-term financial goals.

The choice between Personal Capital and Quicken is dictated by your financial needs. How We Know Which Option is Right for You Get Mint Personal Capital vs Quicken Comparisonįree with Optional Paid Portfolio Management Service

In addition to budget tracking by category, Mint can help you set savings and debt repayment goals, suggest ways to reduce expenses and monitor your credit score.

Quicken for mac rebalancing free#

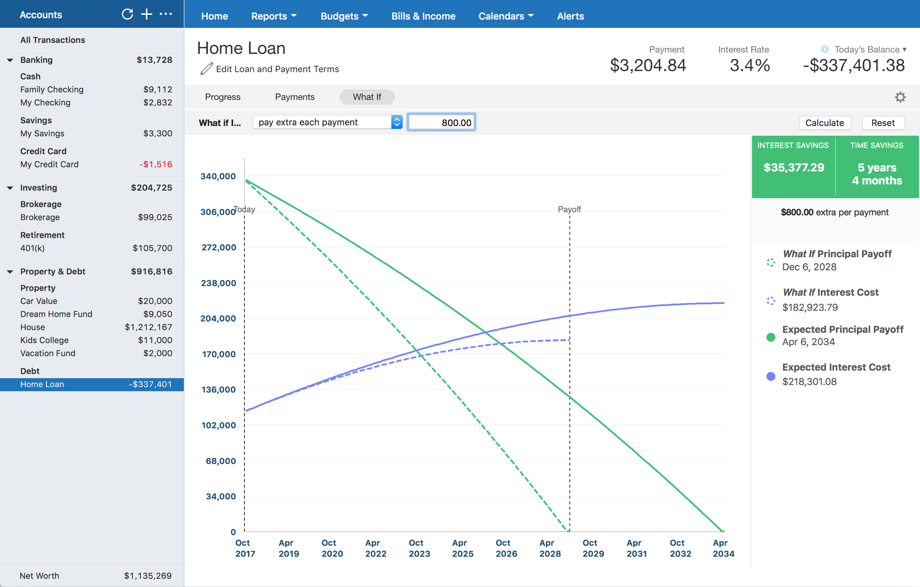

If what you need is a simple tool to manage your income and expenses as well as budget for savings and/or debt repayment, Mint’s free online platform is the solution for you. Get Quicken When an Alternative is Right for You Higher tiers feature online bill payment, investment tracking, real estate management, portfolio analysis, integrated tax reporting, and priority customer support. With tiered annual pricing from $34.99 for the Starter version to $99.99 for Quicken Home & Business (Windows only), you can set up monthly budgeting and forecast cash and savings. Quicken is right for those looking for robust personal finance software along with business accounting and tax reporting. Get Personal Capital When Quicken is Right for You For those seeking active investment support, Personal Capital’s paid service utilizes automated algorithms to invest funds and optimize taxes with fees ranging from.

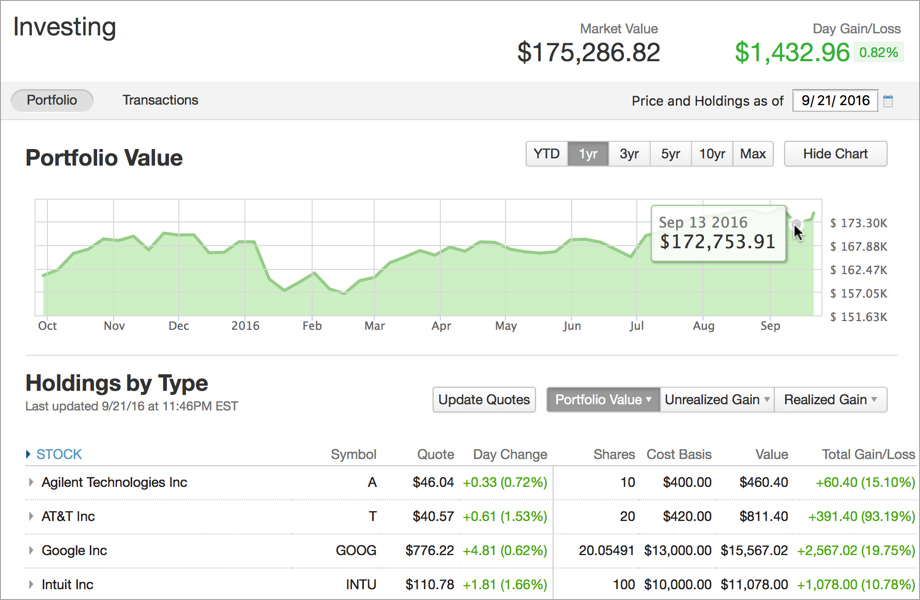

Its secure dashboard tracks net worth and actively manages your portfolio to achieve your retirement goals, with a secondary focus on budgeting and cash management. Personal Capital is the best choice for a free, holistic, personal wealth management tool. Personal Capital vs Quicken: Pricing & Features.How We Know Which Option is Right for You.

0 kommentar(er)

0 kommentar(er)